Majority of young adults prefer used cars as affordable, sustainable alternative

DETROIT, March 22, 2022 /PRNewswire/ -- From vintage clothing to retro furniture finds, thrifting is the shopping mode of choice for many Gen Z and millennial consumers as they look for ways to lessen their impact on the environment. According to a new Ally survey, the same now holds true for car buying.

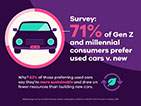

In a survey of 2,000 American adults conducted by One Poll on behalf of Ally Financial, 71% of consumers ages 18-40 say they would rather buy a used car than a new one, even as used car prices hit record highs.

For this age group, sustainability is a key motivator with 63% of used car shoppers stating they would prefer a used car specifically because it's more sustainable and draws on fewer resources than building new cars.

"Sustainability has become a key priority for Gen Z and millennial consumers, and it's impacting the way they think about cars and their car-buying decisions," said Doug Timmerman, president of Dealer Financial Services, Ally Financial. "Whether it be through purchasing an electric vehicle, or a used car, the goal remains the same: to lessen environmental impact."

Eighty-two percent of consumers ages 18-40 agree that electric cars are the future, with 72% saying they'd consider purchasing an electrified vehicle, compared to only 28% of drivers ages 57+. However, cost is still a consideration as nearly half (45%) of Gen Z and millennial consumers said cost could hinder their EV purchase.

With used cars and electric vehicles gaining in popularity as sustainable options, consumers recognize any vehicle choice brings additional expenses. To keep expenses under control in uncertain times, 81% of younger consumers indicate they are more inclined to purchase a vehicle service contract (VSC) due to the pandemic.

"There's a common misconception that electric vehicles have minimal service and repair needs, but that's not necessarily the case," Timmerman said. "Whether consumers are purchasing EVs or used cars in an effort to be sustainable, vehicle service contracts can provide peace of mind for unexpected repair expenses, and help extend the life of the vehicle."

VSCs help cover expenses such as repairs and replacement parts that fall outside the factory warranty including costly high-tech features such as LCD screens, lane departure warning systems, adaptive cruise control and more. As an example, Ally Premier Protection VSCs cover over 7,500 vehicle components and offer other benefits, such as alternate transportation (including ride sharing), roadside assistance and reimbursement for trip interruption caused by a breakdown. Levels of coverage vary by plan and are available for new and used vehicles.

No matter the car type, VSCs can help make it easier to manage unexpected repair costs and maintain vehicles over extended periods of time – something incredibly important to consumers ages 18-40.

About Ally Financial Inc.

Ally Financial Inc. (NYSE: ALLY) is a digital financial services company committed to its promise to "Do It Right" for its consumer, commercial and corporate customers. Ally is composed of an industry-leading independent auto finance and insurance operation, an award-winning digital direct bank (Ally Bank, Member FDIC and Equal Housing Lender, which offers mortgage lending, point-of-sale personal lending, and a variety of deposit and other banking products), a consumer credit card business, a corporate finance business for equity sponsors and middle-market companies, and securities brokerage and investment advisory services. A relentless ally for all things money, Ally helps people save well and earn well, so they can spend for what matters. For more information, please visit www.ally.com and follow @allyfinancial.

For more information and disclosures about Ally, visit https://www.ally.com/#disclosures.

For further images and news on Ally, please visit http://media.ally.com.

Contact:

Ann Smith

Ann.Smith@ally.com

Megan McElduff

Tier One

Mmcelduff@tieronepr.com

SOURCE Ally Financial