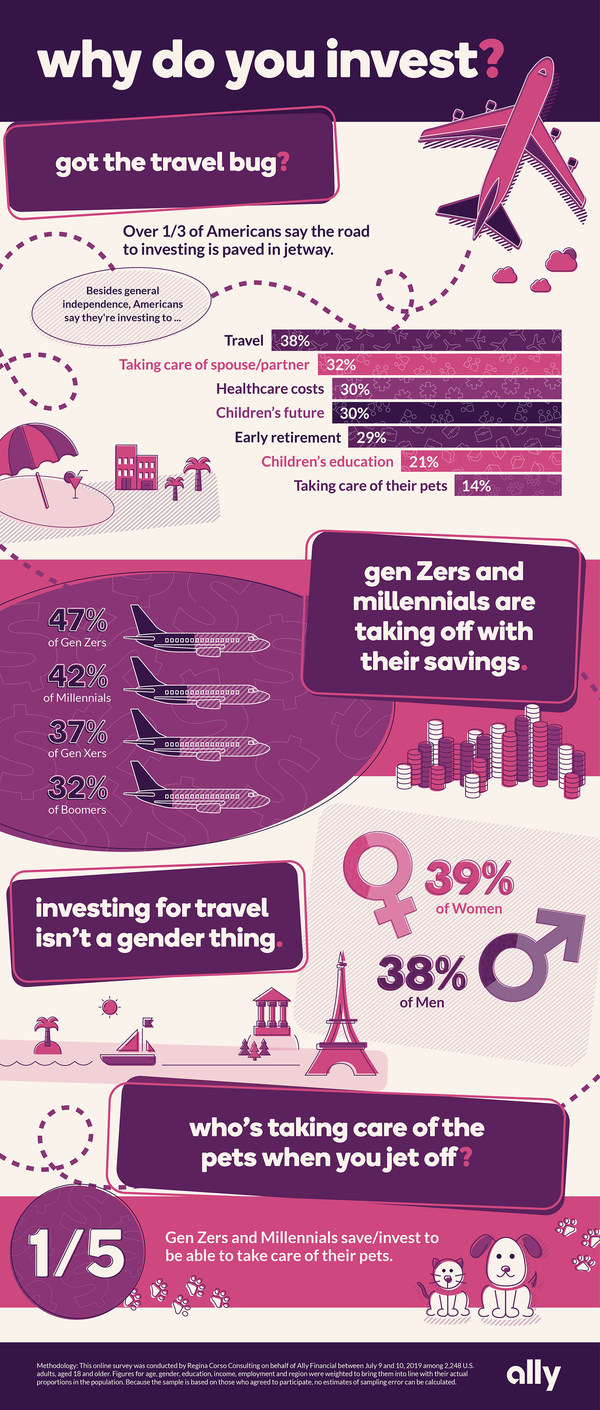

CHARLOTTE, N.C., Sept. 10, 2019 /PRNewswire/ -- A new survey from Ally Invest shows that when it comes to investing and saving, GenZers (47%) and Millennials (42%) are packing the piggy bank for a trip down the jetway.

Across all generations in the independent survey, travel turned out to be the second most commonly identified motivating factor for saving and investing at 38%, just behind the broader goal of achieving financial freedom at 47%. That means for many, snapping an instagrammable moment might outrank investing for the care of a spouse/partner (32%), healthcare costs (30%), their children's future (30%), early retirement (28%), children's education (21%), taking care of their pets (14%), and ability to open their own business (11%).

"People are working harder than ever, and there is no better way to enjoy your well-earned time off than by seeing the world. But, it's also clear consumers are serious about saving for the future and ensuring they'll have the financial freedom to live well throughout their lives," said Lule Demmissie, president of Ally Invest, the wealth management arm of Ally Financial. "At Ally, we believe you can have your cake and eat it too. We are here to help consumers with the travel bug get to the Eiffel Tower or even Machu Picchu, without stepping on their nest egg."

Nearly three-fourths of Americans surveyed say investing is one of the most important things that they do.

Additional Survey Highlights:

Pets are a Priority: One in five GenZers and Millennials are saving/investing to be able to take care of their pets.

Paying Bills vs. Investing: GenZers, Millennials, and GenXers are more likely than Baby Boomers to say they know investing is important, but their near-term expenses mean they can't dedicate much money to investments now.

- GenZ: 73%

- Millennials: 74%

- GenX: 68%

- Boomers: 57%

Early Retirement in the Spotlight: Millennials and GenXers are more likely than GenZers and Boomers to say they save/invest to be able to retire early.

- GenZ: 24%

- Millennials: 35%

- GenX: 32%

- Boomers: 23%

Spend Now, Save Later: Half of Americans agree they want to invest and/or save more, but they enjoy spending money now too much. Broken down generationally:

- GenZ: 63%

- Millennials: 62%

- GenX: 47%

- Boomers: 36%

Investments are NOT FDIC INSURED, NOT BANK GUARANTEED and MAY LOSE VALUE. Investing in securities involves risk; there is always the potential of losing money when you invest in securities.

Methodology: This online survey was conducted by Regina Corso Consulting on behalf of Ally Financial between July 9 and 10, 2019 among 2,248 U.S. adults, aged 18 and older. Figures for age, gender, education, income, employment and region were weighted to bring them into line with their actual proportions in the population. Because the sample is based on those who agreed to participate, no estimates of sampling error can be calculated.

About Ally Invest:

Ally Invest is the brokerage and wealth management offering from Ally that exists alongside the firm's award-winning online banking products. Ally Invest offerings consist of a low-cost trading platform for self-directed investors, as well as a suite of affordable, automatically-managed investment portfolios, both delivered through a fully-transparent online process. The combination of low-cost investing with Ally's competitive deposit products gives customers a powerful value proposition for managing their financial well-being.

About Ally Financial Inc.:

Ally Financial Inc. (NYSE: ALLY) is a leading digital financial-services company with $180.4 billion in assets as of June 30, 2019. As a customer-centric company with passionate customer service and innovative financial solutions, we are relentlessly focused on "Doing It Right" and being a trusted financial-services provider to our consumer, commercial, and corporate customers. We are one of the largest full-service automotive-finance operations in the country and offer a wide range of financial services and insurance products to automotive dealerships and consumers. Our award-winning online bank (Ally Bank, Member FDIC and Equal Housing Lender) offers mortgage-lending services and a variety of deposit and other banking products, including savings, money-market, and checking accounts, certificates of deposit (CDs), and individual retirement accounts (IRAs). Additionally, we offer securities-brokerage and investment-advisory services through Ally Invest. Our robust corporate finance business offers capital for equity sponsors and middle-market companies.

For more information and disclosures about Ally, visit https://www.ally.com/#disclosures.

Media Contacts:

Justin Nicolette at Ally

980-312-8636

justin.nicolette@ally.com

Sue Parente at Tier One Partners

781-642-7788

sparente@tieronepr.com

SOURCE Ally Financial