SANDY, Utah, Feb. 5, 2020 /PRNewswire/ -- Ally Bank (Ally), the customer-obsessed banking arm of Ally Financial (NYSE: ALLY), which has grown to be the largest fully digital bank in the U.S., today introduced a collection of smart savings tools to its Online Savings Account that will help people save more money faster and with less effort than ever before.

"We've all seen the statistics about how many Americans, if hit with a crisis, couldn't come up with $400," said Diane Morais, president of Consumer and Commercial Banking Products at Ally Bank. "People know they need to save but they need real help. We went right to the heart of the problem, developing solutions and new tools that foster healthy and effective saving behaviors and inspire people to reach their near- and long-term financial goals."

Over 18 months, Ally talked with thousands of customers and non-customers alike about their confidence in their financial health, their attitudes toward saving, and the mental and emotional barriers that keep them from meeting their goals.

"The research affirmed people not only want, but welcome, help improving their financial lives," said Anand Talwar, deposits and consumer strategy executive at Ally Bank. "Out of that, we became laser focused on what we could do to encourage real behavioral change."

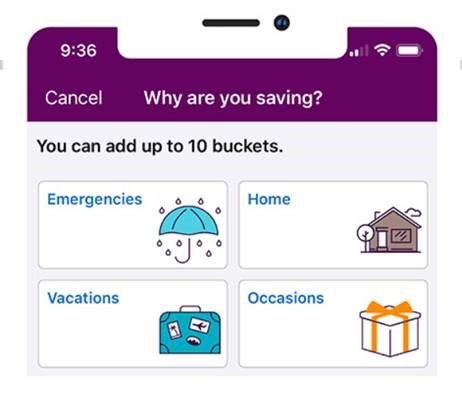

Enter Buckets, which organize funds and help customers visualize different savings goals, all in one account. Like "digital envelopes," customers can customize buckets to reflect what matters most to them, from "Visiting Mom for the Holidays" to "Engagement Ring." Buckets also give users a clear picture of exactly where they stand with each priority.

"The next big 'ah ha' was realizing we need to make it exceptionally easy for people to save," said Talwar. "It's not enough to offer tips or advice; we need to actually help people do it and automation is the key."

Boosters automate saving through regular, ongoing contributions that add up over time. Notably, boosters work with customers' existing checking accounts, whether they bank with Ally or another institution.

- For confident savers who know how much they can save each month, Recurring Transfers let them "set it and forget it" by automatically moving funds into savings on a regular schedule.

- Surprise Savings analyzes a linked checking account, considering cash flow, spending patterns, upcoming bills and overall account balance, to find amounts under $100 that are "safe to save." It then transfers those funds automatically into savings. For those customers who link an external account, they must enroll in Ally Bank's Account Aggregation Service.

"Early testing with real Ally customers shows that using just one of the boosters can accelerate savings by more than five times than interest rate alone," said Talwar. "The ease of saving helps cement a new habit, and the feeling of success and momentum that comes from watching your money grow creates a snowball effect that keeps people going."

Dr. Ted Klontz, financial psychologist and Associate Professor of Practice and founder of the Financial Psychology Institute at Creighton University, agrees. "Americans need to rethink their savings strategies and foster new behaviors that fit the way we think and live now. Instead of placing the emphasis on sacrifice, guilt and depriving ourselves of the things we need and want, making saving personally and unexpectedly rewarding proves to be the most effective motivations for today's consumers."

About Ally Financial Inc.

Ally Financial Inc. (NYSE: ALLY) is a leading digital financial-services company with $180.6 billion in assets as of December 31, 2019. As a customer-centric company with passionate customer service and innovative financial solutions, we are relentlessly focused on "Doing it Right" and being a trusted financial-services provider to our consumer, commercial, and corporate customers. We are one of the largest full-service automotive-finance operations in the country and offer a wide range of financial services and insurance products to automotive dealerships and consumers. Our award-winning online bank (Ally Bank, Member FDIC and Equal Housing Lender) offers mortgage-lending services and a variety of deposit and other banking products, including savings, money-market, and checking accounts, certificates of deposit (CDs), and individual retirement accounts (IRAs). Additionally, we offer securities-brokerage and investment-advisory services through Ally Invest. Our robust corporate finance business offers capital for equity sponsors and middle-market companies.

For more information and disclosures about Ally, visit https://www.ally.com/#disclosures

For further news regarding Ally, please visit the Ally press room at http://media.ally.com

Contact:

Justin Nicolette

Ally Financial

Justin.nicolette@ally.com

980-312-8636

SOURCE Ally Financial